Wealth Accumulation Premium Financing Foreign Nationals

THE PROBLEM: Federal Estate Death Tax

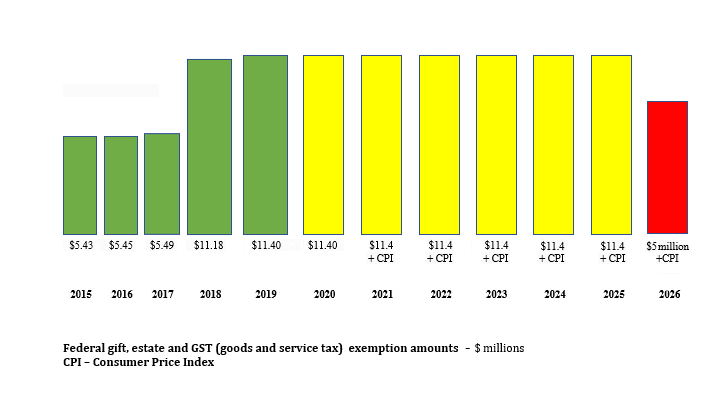

In 2020 the tax code provides that every penny in excess of $11.58 million dollars per individual ($23.16 million per married couple) is taxed upon death at rates that rapidly escalate to 40%. For the truly wealthy, an $11.58 million-dollar estate tax exclusion doesn’t begin to preserve the substance of what you have worked so hard to accumulate.