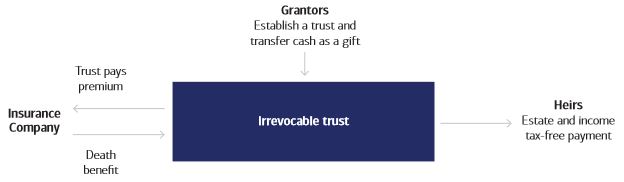

Life Insurance held in an ILIT (Irrevocable Life Insurance Trust)

Developing a life insurance strategy today will help efficiently transfer guaranteed, tax-free cash along to the client’s heirs in the future. Life insurance should be viewed not only as an asset within your overall portfolio but also as an investment alternative – one that helps you stay diversified.

There is a lot of value to the word “guarantee”. Estate tax mitigation is a key element of estate planning, but in order to be effective in minimizing tax liability, it is vital to understand the criteria for imposing both estate and income taxes.

With the right life insurance strategy, you can safeguard who and what you care about while creating opportunities for your wealth to go further.

Life Insurance is the time-tested solution of leveraging assets into dollars needed to pay future taxes so you can pass on what you’ve worked so hard to accumulate. Life insurance policies can help high net worth families hedge against risk, too, especially when placed in trust.

Life insurance is not an expense. Life insurance is future money.